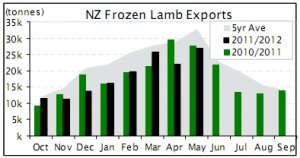

May exports were 4.4% lower than May last year at $4.4billion. This was largely due to the drop in value of meat and edible offal, which tends to be a common theme from month to month. Meat and edible offal exports were down 13% or $82million with volumes only down 2.2%. Frozen lamb exports continue to drag the chain, which were down 28% or $64million in value. Total NZ frozen lamb exports in May were down just 3.3% which emphasises the large drop in overseas prices NZ exporters are facing when compared to the same time last year.

China taking up some of the slack

While many destinations are not interested in frozen lamb at present, China seems to be taking up some of the slack. China bucked the trend in May, with the value of NZ frozen lamb imports actually increasing. This was driven by the massive jump in the volume of NZ lamb exports to China, up a whopping 48% year on year. Even since April, exports in May were up 37%. Virtually all of NZ's lamb heading to China is made up of frozen lamb, as they prefer the cheaper cuts. This is one market NZ can rely on to clear the large quantity of frozen lamb in storage, especially seeing China is importing more shoulders and legs this year than usual.

Heavy lambs hard to place

NZ and Australian farmers are killing out at heavier weights than previous seasons which is making it difficult for exporters, seeing lighter cuts are preferred by overseas consumers. With farmgate returns having dropped more than expected, many farmers have held onto lambs waiting for the market to recover which is making lambs heavier and heavier. NZ lambs are now averaging 18.41kg cwt for the season, up half a kilo on last season. In Australia lamb weights have reached an average of 22.62kg this year, but keep in mind they predominantly farm merinos so carcase weights are typically higher. Some lambs are reportedly dressing out up to 38kg and traders are finding it virtually impossible to find markets for cuts from this size. Just 10 years ago, Australian farmers would target an 18-19kg cwt, but it is more like 23-24kg cwt now.

|

|

Market Brief by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |